How Do I Find My Principal Business Code On 1099 Nec Principal Business Activity Codes If engaged in more than one unrelated business activity select up to two codes for the principal activities List first the largest in terms of gross

The principal business codes are listed on pages C17 C18 http www irs gov pub irs pdf i1040sc pdf Note that if your business can t be classified enter You can get the general instructions from General Instructions for Certain Information Returns at IRS gov 1099GeneralInstructions or go to IRS gov Form1099MISC or IRS gov Form1099NEC Continuous use form

How Do I Find My Principal Business Code On 1099 Nec

How Do I Find My Principal Business Code On 1099 Nec

https://digitalasset.intuit.com/IMAGE/A88UWBzz0/f1099nec-4.png

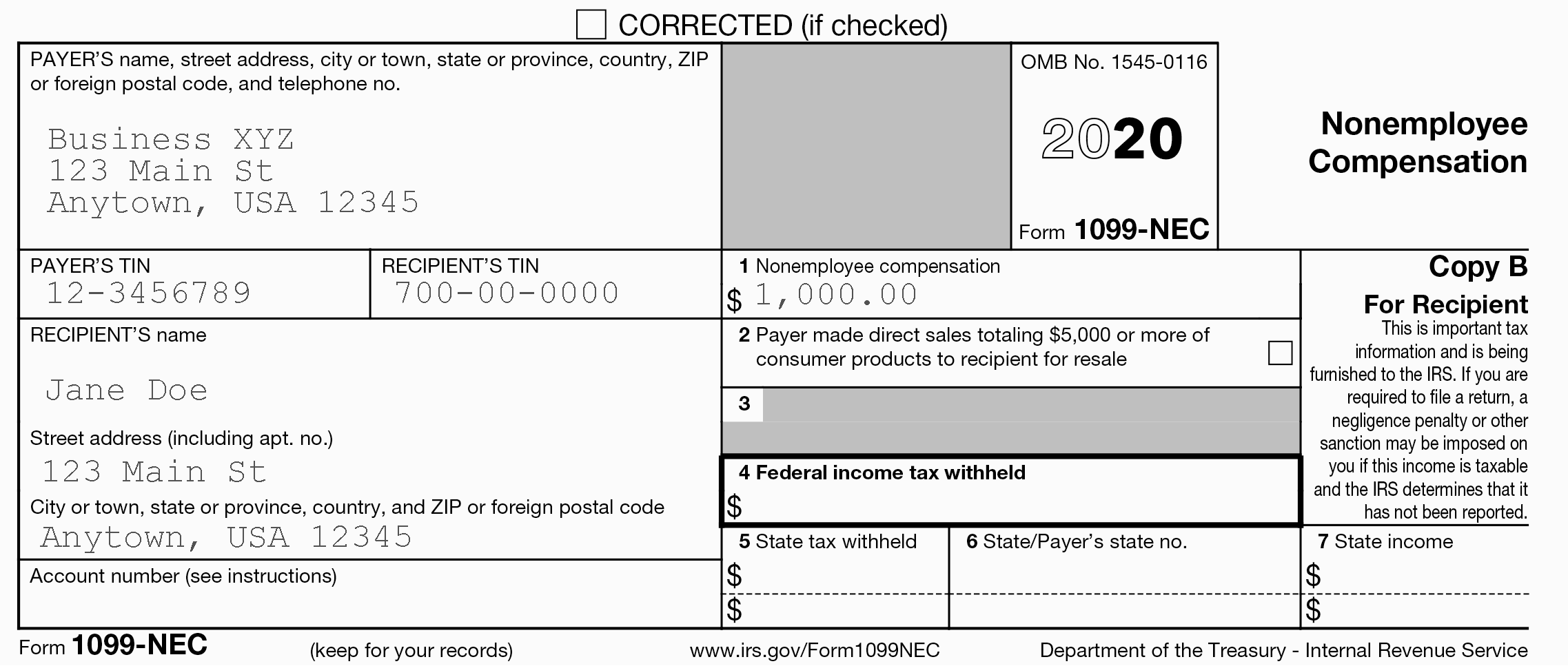

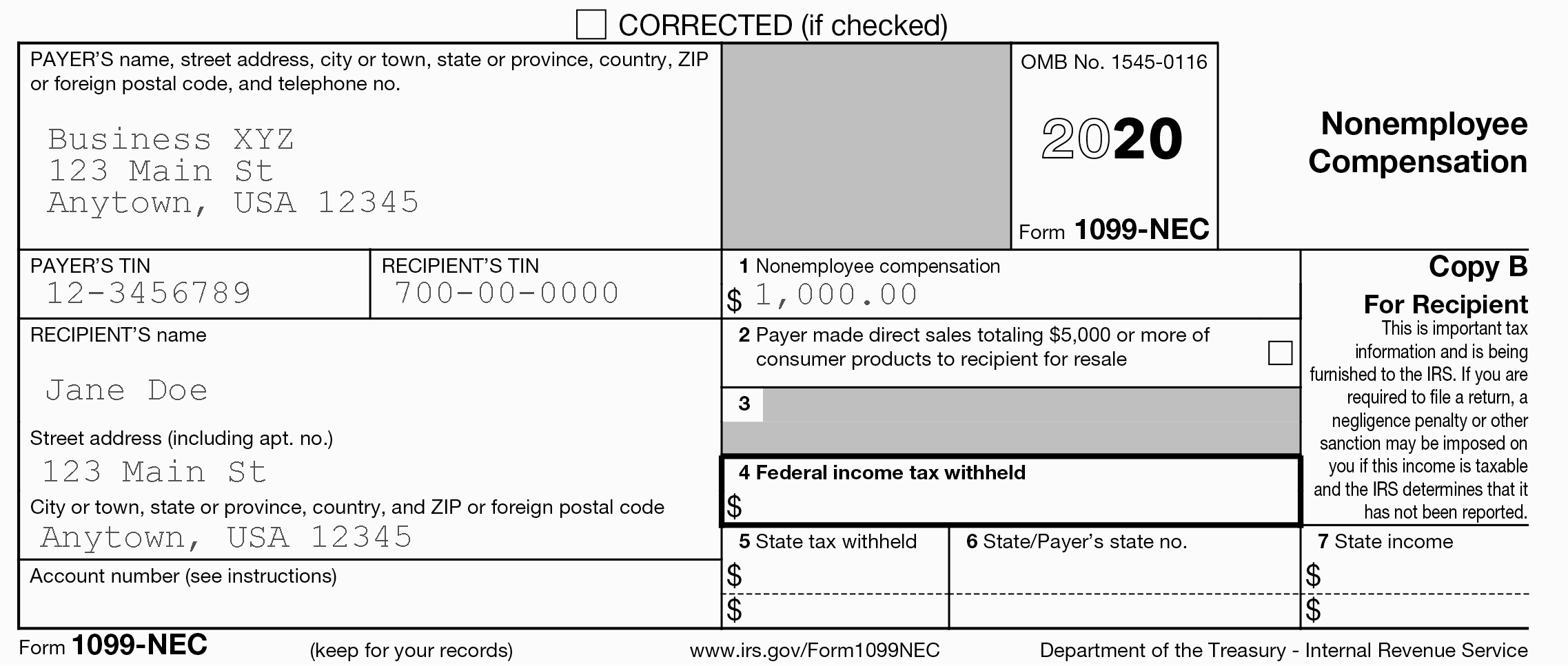

What You Need To Know About Form 1099 NEC Hourly Inc

https://assets-global.website-files.com/5e6aa7798a5728055c457ebb/629e4e8a0392ecfd4a163419_1099nec.png

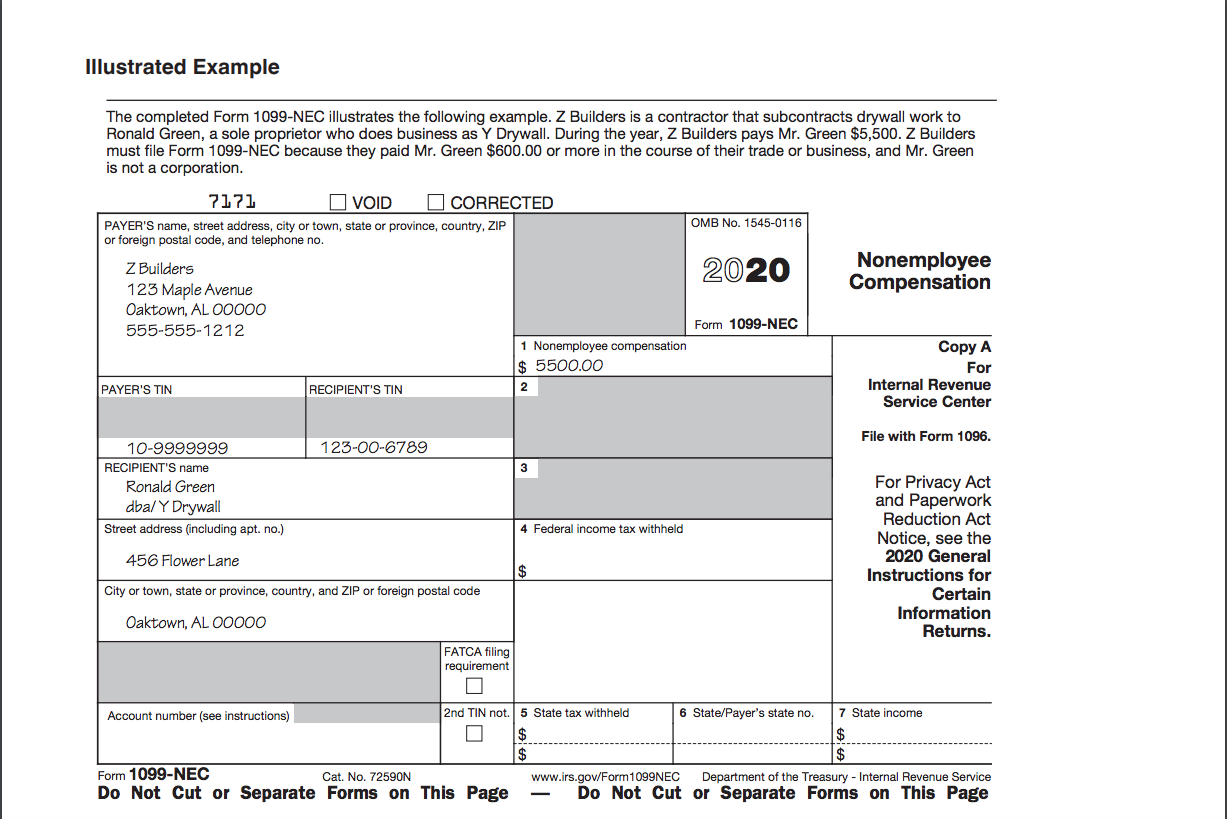

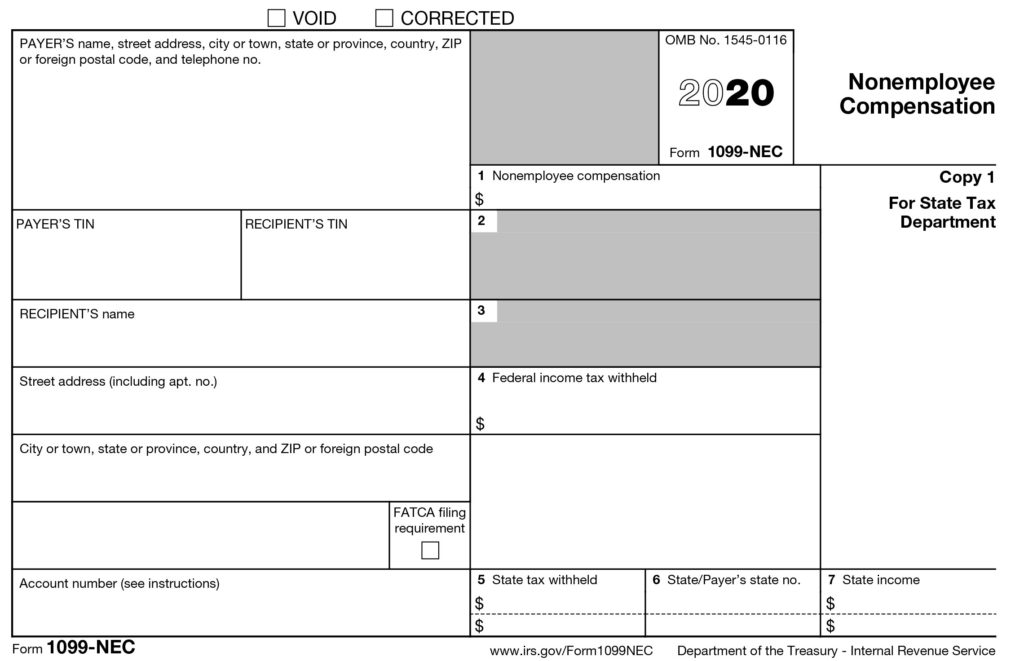

Form 1099 NEC Instructions And Tax Reporting Guide

https://www.efile4biz.com/images/1099-nec-overview-thumbnail.png

Log into principal and select My profile Under My documents you will find a section called Tax documents That s where you ll find documents like your 1099R If you are a As the tax season approaches it s vital to ensure you ve received a 1099 NEC from each client or business that compensated you over 600 in the tax year Collecting these forms is the foundation of accurate tax filing for

Form 1099 NEC is used to report payments of 600 or more made to non employees such as independent contractors Independent contractors are responsible for both the employer and employee portions of Social Security The 1099 NEC is the Internal Revenue Service IRS form to report nonemployee compensation that is pay from 1099 independent contractor jobs also sometimes referred to as self employment income Examples of this include

More picture related to How Do I Find My Principal Business Code On 1099 Nec

Introducing The New 1099 NEC For Reporting Nonemployee Compensation

https://businessasap.com/wp-content/uploads/irs-1099nec-form-example.png

What You Need To Know About Form 1099 NEC Hourly Inc

https://assets-global.website-files.com/5e6aa7798a5728055c457ebb/629e4ee6127989d450160cb6_w9.png

New IRS Form 1099 NEC For Nonemployee Compensation

https://www.kegacpa.com/wp-content/uploads/2020/11/Form-1099-NEC-KEGA.png

Information about Form 1099 NEC Nonemployee Compensation including recent updates related forms and instructions on how to file Use Form 1099 NEC to report The principal business code for taxes is also sometimes called the professional activity code Where to find the code Principal business codes are assigned in alphabetical order of the

There are a few ways to file 1099 NEC forms including Online You can e file your 1099 NEC Form with the IRS through the Information Returns Intake System IRIS Taxpayer Portal This is a free filing method Any business that made nonemployee compensation payments totaling 600 or more to at least one payee or withheld federal income tax from a nonemployee s payment in

:max_bytes(150000):strip_icc()/1099NECa-1c0dfec2e4624451845d4d567aef23cf.jpg)

Irs 1099 Nec Form 2023 Printable Forms Free Online

https://www.thebalancemoney.com/thmb/iZBDhnNMF9FpcM9PCMUPh-YyG3w=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/1099NECa-1c0dfec2e4624451845d4d567aef23cf.jpg

Freelancers Meet The New Form 1099 NEC

https://1040.staticserve.net/assets/blog/images/1099-NEC-2.jpg

https://www.irs.gov › pub › irs-soi

Principal Business Activity Codes If engaged in more than one unrelated business activity select up to two codes for the principal activities List first the largest in terms of gross

https://ttlc.intuit.com › community › business-taxes › ...

The principal business codes are listed on pages C17 C18 http www irs gov pub irs pdf i1040sc pdf Note that if your business can t be classified enter

What Is Form 1099 NEC For Nonemployee Compensation

:max_bytes(150000):strip_icc()/1099NECa-1c0dfec2e4624451845d4d567aef23cf.jpg)

Irs 1099 Nec Form 2023 Printable Forms Free Online

Instructions For Forms 1099 MISC And 1099 NEC 2020 Internal Revenue

The 1099 Survival Guide Navigating Tax Season

Nec 2024 Code Kati Sascha

The New 1099 NEC IRS Form For Second Shooters Independent Contractors

The New 1099 NEC IRS Form For Second Shooters Independent Contractors

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 NEC Income

Here Is The Difference Between The Form 1099 NEC And Form 1099 MISC

Everything Old Is New Again Form 1099 NEC Reporting PYA

How Do I Find My Principal Business Code On 1099 Nec - This list provides each principal business activity with its associated IRS code designed to classify an enterprise by type of activity