365 Day Method Real Estate Formula 365 day method The 365 day method uses the actual number of days in the calendar The steps in the calculation are the same for annual and monthly prorations The steps are SLIDE

First determine the daily tax rate by dividing the annual tax by 365 days assuming a calendar year method So 3 600 365 9 86 per day Next multiply this daily rate by the number of days the buyer will own the property Use the 360 day method and assume the buyer owns the day of closing The solution to this real estate math problem is The 360 day method assumes each month has 30

365 Day Method Real Estate Formula

365 Day Method Real Estate Formula

https://i.pinimg.com/originals/6e/4f/9a/6e4f9af4f9a55a7a5ed4ac2ca8b63a3e.png

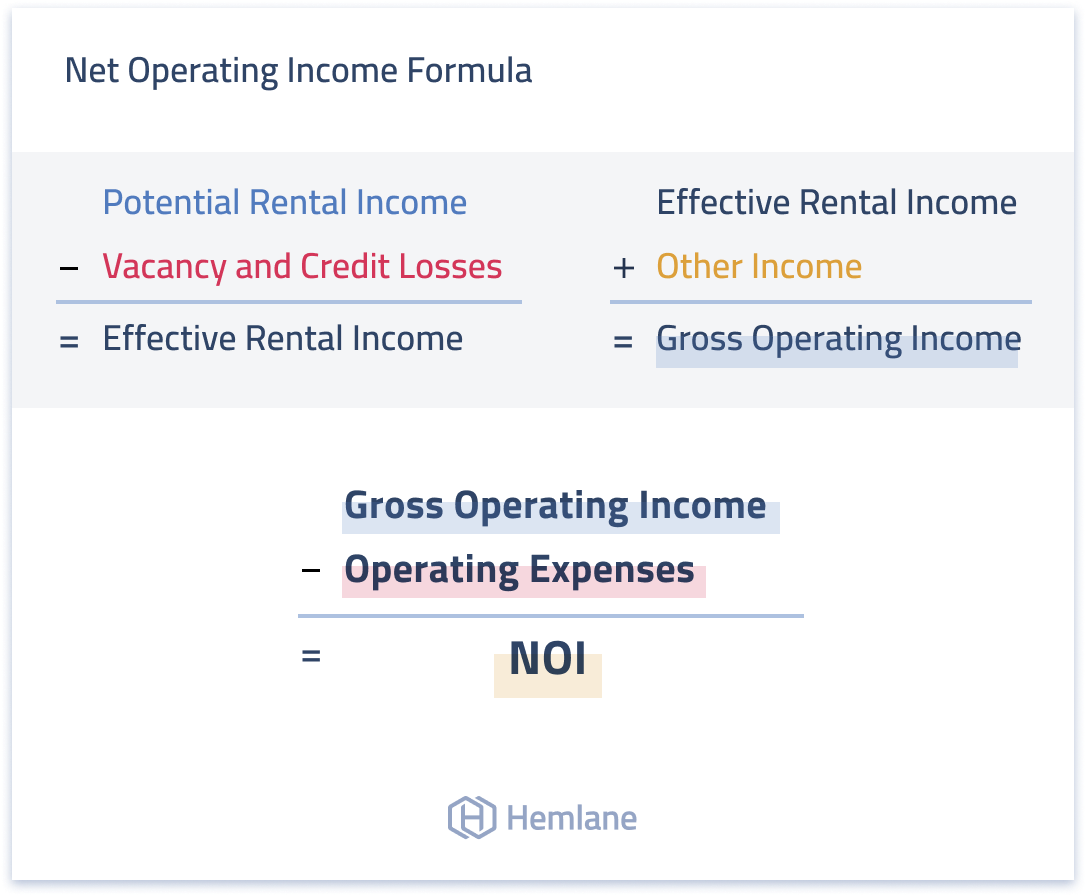

The BRRRR Method For Real Estate Investing Morris Invest

https://morrisinvest.com/wp-content/uploads/2017/04/the-brrrr-method-real-estate-investing-1080x661.jpg

Real Estate Investment Formulas 1 Easy Triangle Trick To Remember Them

https://donvalleytimes.com/wp-content/uploads/2021/01/Real-Estate-Investment-Formulas-783x1024.jpg

Prorated Tax Total Annual Tax Number of days in the tax year Number of days remaining Here Total Annual Tax refers to the total tax amount levied on the property for a specific tax year The number of days in the tax Traditionally there are two common methods used for calculating interest i the 365 365 method or Stated Rate Method which utilizes a 365 day year and ii the 360 365

There are two methods of prorating real estate taxes for your real estate exam the 365 day method which is what this video will show you and the 360 day method more 365 day method ldentify an item and the amount needing to be prorated Divide by 365 to get the daily rate Divide by 366 in a leap year Multiply the daily rate by the number of days the

More picture related to 365 Day Method Real Estate Formula

Real Estate Math Formulas T Method EZ Real Estate Math

https://ezrealestatemath.com/wp-content/uploads/2019/05/T-Method-Find-Total-Example.png

Can The BRRRR Method Help You Kickstart Your Real Estate Journey

https://financialfreedomcountdown.com/wp-content/uploads/2022/01/BRRRR-Method-Real-Estate-Investing.jpg

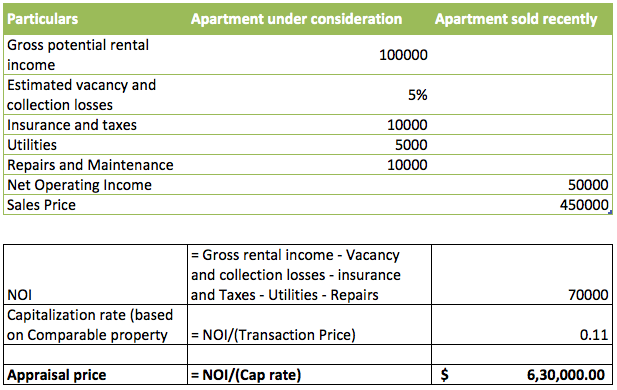

Real Estate Valuation Part 2 Income Approach Finance Train

https://financetrain.sgp1.cdn.digitaloceanspaces.com/2012/02/Real-Estate-Income-Approach.png

For the monthly proration using the 365 day method solve first for the daily rent amount 1 380 31 or 44 516 Since the landlord received the rent and owes the buyer portions of Formulas for 30 day 360 day statutory method Proration monthly amount multiplied by the months daily amount multiplied by the days Example annual tax bill is 18 000 Closing is on April 10th What is the sellers share of

Two common methods used are the 365 day method and the 30 day month method The 365 day method divides the total annual expense by 365 days to calculate a daily rate The 30 day month method simplifies To calculate the prorated amount you can use the following formula Prorated Amount Total Amount Proportion of Time or Usage Total Time or Usage Determine the total amount

Why The Cost Method Is Used For Pricing Real Estate Economy Today

https://2.bp.blogspot.com/-hX1gB6a5V5Q/XHVMcusgzEI/AAAAAAAAQSg/PhrdXKI00ukECUwW4Bh65ZGUvKsvn9BJQCLcBGAs/s1600/Why%2BThe%2BCost%2BMethod%2BIs%2BUsed%2BFor%2BPricing%2BReal%2BEstate.png

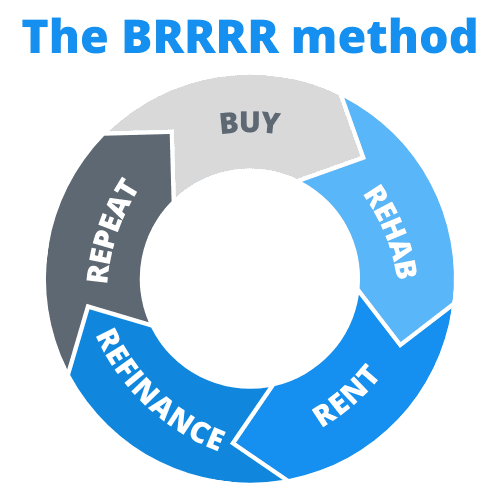

Net Operating Income Formula Astonishingceiyrs

https://resources.hemlane.com/content/images/2021/06/Net-operating-income--NOI--formula-for-real-estate-investors.png

https://www.proeducate.com › courses › FLRE

365 day method The 365 day method uses the actual number of days in the calendar The steps in the calculation are the same for annual and monthly prorations The steps are SLIDE

https://bluenotary.us › calculate-proration-i…

First determine the daily tax rate by dividing the annual tax by 365 days assuming a calendar year method So 3 600 365 9 86 per day Next multiply this daily rate by the number of days the buyer will own the property

Real Estate Training With Scientific Method Professional Real Estate

Why The Cost Method Is Used For Pricing Real Estate Economy Today

Method Real Estate Advisors

Are 365 Days Massimo And Laura Dating In Real Life

How To Use Discounted Cash Flow For Real Estate Valuation

How To Use Social Media For Real Estate Social Media Marketing

How To Use Social Media For Real Estate Social Media Marketing

The BRRRR Method A Real Estate Portfolio Building Blueprint

Exploring The Cost Approach Method Real Estate Exam Ninja

Breaking Down The BRRRR Basics SIMM Capital Group Real Estate

365 Day Method Real Estate Formula - Traditionally there are two common methods used for calculating interest i the 365 365 method or Stated Rate Method which utilizes a 365 day year and ii the 360 365